SPANISH MORTGAGE EXECUTION- Embargo, Spanish repossession

When there are monthly payments on arrears, usually, there the Spanish banks give 2 solutions to execute an unpaid mortgage: 1.- Public Auction – Embargo Once a determinate number of non-paid monthly mortgage payments occur, the bank sue the property in the Courts, and open a seizure process. In this moment, the costs of the […]

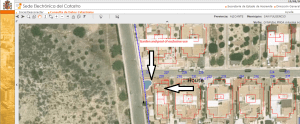

LEGALIZATION OF CONSTRUCTIONS OR EXTENSIONS: UPDATING DEEDS AND CATASTRO REGISTRATION

[vc_row][vc_column][vc_column_text]It is really common in practice that owners of properties, after acquisition, have made new buildings on their properties, or new extensions. For example, a pool, a garage, an outside kitchen or toilette, or a second floor. When this happens, it is necessary to legalize these constructions with a two main actions: Updating deeds, and registering […]

HORIZONTAL DIVISIONS ON SPANISH URBANIZATIONS

Horizontal Division in Urbanizations means that the land where the different houses from the urbanization are placed belongs to all the owners “in common”. This Horizontal Division is a way used in urbanizations and buildings where the different owners own the 100 % from their houses and “in community” the land of the urbanization. So, the […]

WEALTH TAX – VALENCIA REGION UPDATED 2024

Taxable event Be the owner of goods and rights in Spain of economic content before December 31 of each year. Taxable Only natural persons. Legal persons (companies, societies, etc.) are not taxed by this tax The following: In general, natural persons who have their habitual residence in Spanish territory are taxed by personal obligation, who […]

SPANISH TAXES PAYABLE WHEN BUYING PLOTS OR LAND FOR CONSTRUCTION

For the correct identification of the Spanish taxes derived from the purchase of a plot or land intended for construction, several factors must be taken into account: Tax status of the seller Tax status of the buyer Nature or urban classification of the land or plot Nature or urban classification of the construction NATURE OF […]

IMPÔT SUR LES CONSTRUCTIONS, INSTALLATIONS ET TRAVAUX

L’impôt sur les constructions, installations et travaux (ICIO) est un impôt indirect, communal, volontaire d’établissement et de gestion exclusivement attribué à la commune qui l’institue. Événement imposable Le fait générateur de l’ICIO est constitué par la réalisation, sur le territoire communal, de toute construction, installation ou ouvrage pour lequel l’obtention d’ un permis de travaux […]

TAX ON BUILDINGS, INSTALLATIONS AND WORKS

The tax on constructions, installations and works (ICIO) is an indirect, municipal, voluntary establishment and management tax exclusively attributed to the municipality that establishes it. Taxable event The taxable event of the ICIO is constituted by the realization, within the municipal term, of any construction, installation or work for which the obtaining of a works […]

MILITAR PERMIT TO BUY RUSTIC PROPERTIES IN SPAIN FOR NON EU NATIONALS

ASPECTS TO TAKE INTO ACCOUNT WHEN BUYING A PROPERTY IN SPAIN MILITARY AUTHORISATION According to Law 8/1975, and the RD 689/1978 that develops it, for acquisitions of properties Inter vivos and mortis causa by national citizens of States that do not belong to the European Union (included in the Schengen Area),there is a requirement to […]

HOW MUCH IT COSTS TO INCLUDE MY WIFE/CHILDREN IN THE DEEDS OF MY SPANISH PROPERTY?

“I have a property by my own Spain. I have the 100 % of the ownership of the property. How much will it cost to change the title deeds to my wife’s name before I die, or to pass her 50 % of the property?” TLACORP ANSWERS: Please, be informed that to pass the property to your wife is considered […]

NEW BECKHAM-NOMAD DIGITAL -SPANISH LAW 2023- FISCAL ADVANTAGES

NOMAD DIGITAL WORKERS LAW DECEMBER 2022 – NEW SPANISH “BECKHAM LAW” The Spanish system aimed at attracting foreign talent is widely known, through a special tax regime for workers posted to Spanish territory, better known as the Beckham Law (LIRPF art.93). This system results in those displaced to Spain being able to “opt” to be […]