What is Catastro in Spain?

“Catastro” is the institution which considers properties for maps, drawings, plans, and is the source of the valor catastral, the assessed value of property for Tax purposes.

Is it the same as Registro de la Propiedad?

No.

Whilst the Registro de la Propiedad and the escritura may well confirm the ownership of a property and the conditions of the same, like in which percentage, if there are limitations or charges (like mortgage, public auctions, Tribunal disputes,etc), the Cadastre will give you a better understanding of the boundaries, the exact location of the property (usually in a visual form), size and description of the property, usually with maps, location, and drawings.

But, when you complete the building of a house (or an extension like a new room), or othe construction like a pool, garage, shed, etc, then you must inform the land registry about this new change on the property, but ALSO to Cadastre .

You must provide plans and drawings to Cadaste about these new buildings, or new extended parts of your property. If you do not do so, you can have future problems because the Cadastre will never know about the existence of that new constructions.

There is a general misconception from which owners, when they complete the construction of a house, or the extension of an existing construction, or others (like garages, pools, etc), they think that Catastro will automatically register these constructions when passed by a notary. Unfortunately, this is not the case. When you complete any of these works, you have to declared them at the notary, land registry, and the Catastro.

Once the construction is duly inscribed in the Catastro, the job is finished, and soon (sometimes it takes around 1 or 2 years) you will start receiving the bills from the Council Tax.

Catastral records for many properties in Spain are out of date and inaccurate

The Catastral system has been used to formulate the value of properties and therefore to fix the taxable level on each property. For many Spaniards the avoidance of tax is a national past-time and many of them failed to update their Catastral details for fear of paying an increased level of tax.

Is it obligatory to get updated registration of constructions in Catastro?

This updating of the Catastro was always a voluntary system so anyone who failed to update their property in the Catastro (and therefore saved on the tax due) was doing nothing wrong. In many cases nowadays, you will find Spanish owners very reluctant to update their property in the Catastro and it is very difficult to persuade them otherwise.

But, now, in 2014, it is OBLIGATORY. So, now, it has been established a period of 2 years to REGULARIZE and UPDATE CATASTRO. Catastro has noted that there is a high number of properties that are not updated in the Catastro database. Usually, these properties have under-declared size of building, or parts of the property (like pool, garages, or other parts of the house), not declared in Catastro, and, consequently, PAYING LESS COUNCIL TAX THAT THEY SHOULD. Thus, there is now a process of regularization and update of properties in Catastro which ends on 2016. So, it is absolutely necessary that you ask for legal advice to check if you have to UPDATE YOUR CATASTRO RECORDS.

Click here to know more about the process of updating properties in Catastro.

If your property was not updated in Catastro, you should be paying LESS COUNCIL TAX THAN YOU SHOULD. So, once you have presented the necessary documents to Catastro, and the regularization process is completed, Catastro may send you retrospective bills for the amount of Council Tax not paid for the undeclared constructions up to 4 years back.

Click here for more information about Council Tax for undeclared constructions.

So, as well to consult the land registry records of the property, it is always highly recommendable to consult the catastro to check how the property is inscribed and recorded.

What is the CADASTRAL REFERENCE (In Spanish – “Referencia Catastral”?), and how to obtain it?

The Cadastral reference is a code to identify the property in the Cadastral records and maps. It is the code used by the Cadastro office to:

- Locate the property in the Cadastral records

- Identify the ownership of the property

- Identify the property to local “Council Tax” or “IBI – Impuesto de Bienes Inmuebles”.

How to obtain the CADASTRAL REFERENCE?

Usually, there are 2 ways:

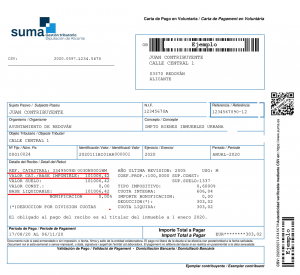

- At the receip/bill of the Council Tax – IBI

- In the content of the Purchase deeds

The code use to be like this: 03011A004001759000WZ , or like this 002501100YH57E0011UI (See pictures below)

What is the CADASTRAL VALUE or “Valor Catastral”?

The Cadastral Value is the tax value of the property used by the Catastro office to calculate the “Council Tax” or IBI on the property.

It is also the Value used to calculate the YEARLY RESIDENT/NON RESIDENT TAX (models Income Tax – IRPF 100 – or IRPF 210).

The “Valor Catastral” or “Cadastral Value” is the same as “Fiscal or Tax Value” of the property?

No. It is not the same. The “Fiscal or Tax Value” of a property (called in Spanish as “Valor Fiscal ” or “Valor de Referencia”), is the value of the property used to calculate the PURCHASE TAX on a property acqusition. The Fiscal or Tax Value is calculated using the “Cadastral Value”, but they are 2 different Values.

In some bills / receipts, the Catastral Value is mentioned as:

- “Valor Catastral”

- “Val.Cat”

- “Base Liquidable”

As conclusion:

- You will be requested to provide the “Catastral Value” or “Valor Catastral” for the following taxes:

- Council Tax- IBI

- Income Tax, Rent tax, etc – Model 210 (Non resident Tax), Model 100 (Resident Tax), etc.

- You will be requested to calculate the “Fiscal/Tax Value” or “Valor Fiscal/Valor de referencia”, only when you are in process to buy a house in Spain.

How to obtain the Cadastral Value of a property?

The sole way to obtain the Cadastral Value of a property is consulting the IBI bill (“Recibo de IBI“), which usually you should receive every year on your bank account (in case you have this payment domiciled on your bank account), or by post (in case you have not the payment domiciled on your bank).

Special considerations of properties in Rustic Land

“CATASTRO URBANO” vs “CATASTRO RUSTICO”

“I have a property in RUSTIC LAND, with 2 bills :

- The villa is registered as “urbana”, and pays an independent bill of IBI as “IBI URBANO”

- The land is registered as “rustica”, and pays an independent bill of IBI as “IBI RÚSTICO”

TLACORP ANSWER:

These kind of situations are quite normal for the properties in rustic land, where the land is always rustic, and pays Council Tax for rustic (IBI rustico), and the houses are considered as per Council Tax of urbana (IBI urbano).

Please, note that NOT ALWAYS rustic land properties have 2 separate cadastral references. Depending of the area of Spain, we may find areas where houses in rustic land only have ONE Cadastral reference (which covers both, the land and the house), and only ONE Catastral Value (which also covers both, the land and the house).

Which of the 2 bills and references are correct?

At this respect:

- You will have to pay 2 bills of IBI, one as “rústica” for the land, and the other as “urbana” for the house.

- There will be 2 Catastral references: one as “rústica” for the land, and the other as “urbana” for the house.

- There will be 2 Catastral Values: One for “rústica” for the land, and the other as “urbana” for the house.

Considerations about Model 210 Non Resident Tax for a house in rustic land

As stated above, where a house is situated in rustic land, as there may be 2 cadastral references, with 2 Catastral Values, which are the implications when preparing Model 210 Non Resident Tax?. How to declare that?, In 2 separate declarations?, or both groupping in a sole declaration?

The answer is the following: The Spanish Non Resindent Tax (Model 210 IRPFNR) taxes:

- Model 210 – Income Tax concept: Rental and incomes obtained from any kind of Spanish properties (urban, rustic, commercial, industrial, etc.). So, in the moment in which you are receiving incomes from a Spanish property as renting a plot of land for agricultural purposes, or renting a house/apartment/garage, etc, you have to declare, and pay for it.

- Model 210 – Imputed Tax concept: But, in case the property is non rented, then, the tax to pay is for the concept of the tax called “imputed tax” and not for the “incomes” received. This imputed tax taxes properties in Spain where are not used as permanent residence by owners. This tax only taxes “urban properties”, and not “rustic land properties”.

So, as conclusion: When you have a property in rustic land, with 2 cadastral references, and 2 cadastral values:

- If you obtaining rent or incomes from the land (for example renting for agricultural, or selling fruits, etc), you have to declare these incomes in a separate Model 210 for “Incomes”, even if the rent is received from the rustic land. The same if incomes received from activity of rent of the house, commercial construction, etc.

- But, in case you are NOT receiving any incomes from your rustic land property, then, the Model 210 will be for the “Imputed Tax” concept, then, the Tax will be for the HOUSE Bill only. So, your tax advicer will demand from you the Catastral Reference and the Catastral Value of the IBI URBANO (the one of the house).

I have a house in Rustic Land, but the IBI I receive mentions “Urbano”.

Does it mean that the house is NOR RUSTIC land but “URBANO”?

There are 2 different concepts here: The Catastro considerations about IBI Tax, and the Urbanistic consideration of the property as “Urbano” or “Rustic Land” at the Planning Construction Dpt.

Considering IBI Tax, while the land may be considered by the Catastro office as “rustic” for IBI purposes, residential constructions built on it will be considered as “urbano” exclusively for Council tax purposes (IBI). So, the Council Tax will be paid as “urbano”, for the house, and “rustic” for the land.

But, considering the Urbanistic classification of the land at the Planning Department of the Town Hall, if the land is considered as “rustic” is because the Town Hall, in the Plan of Construction Development in the area, considers the land as rustic. The land will be always considered as rustic except if the Town Hall changes that classification into “urban”. And, this, independently of how the Catastro considers the property for Council Tax purposes (IBI).

Thus, we confirm your situation is normal, and your land will be considered as “rustic” at the Town Hall, although you are receiving tax considerations of urban from the house in the IBI bill.

Examples of IBI bills where you may find both:

- Catastral reference (“Referencia Catastral”)

- Catastral Value (“Valor Catastral” or “Base Liquidable”)

TLACORP SLP