Frequently Asked Questions: Spanish Non-Resident Income Tax (Model 210) - Imputed tax

Table of Contents

1. What is this tax you’re telling me I have to pay?

2. I’m not renting it out, I just use the house for my family – why do I need to pay tax?

Because Spanish tax law assumes that a second home generates an imputed income, even if you do not rent it. It’s a theoretical or estimated income just for owning a property in Spain.3. Is this the same as the IBI property tax?

No. These are two different taxes:- IBI is a local tax paid to the town hall.

- Non-Resident Income Tax is a national tax paid to the Spanish Tax Agency (Hacienda).

4. When is the IBI paid?

The IBI is usually paid once a year, between July and November, depending on the municipality. We will ask for a copy of this receipt to calculate your non-resident income tax.5. What is a “tax resident”?

You are a tax resident in Spain if you meet any of the following conditions:- You live in Spain more than 183 days per year.

- Your main family or economic interests are in Spain.

6. How do I know if I need to pay this tax?

If you own a property in Spain, do not rent it out, and do not live in Spain full time, then yes — you need to pay this tax every year.7. Do I have to do anything myself?

You only need to:- Confirm that you want to hire us.

- Fill out a simple form we will send you.

- Send us a copy of your latest IBI bill.

8. What is the full process?

- You confirm the service.

- You complete the form we send you.

- You send us your IBI receipt.

- We calculate and file your tax return.

- You make two payments:

- First payment: Our service fee, charged by bank transfer between October and January.

- Second payment: The actual tax amount, charged automatically by the Spanish Tax Agency between January and March.

9. What happens if there is no money in my account?

The Spanish Tax Agency will issue penalties and late fees. We also charge €150 + VAT for each new filing if a declaration must be submitted again.10. Can I pay both the tax and the service fee directly to you?

No. The tax must be paid directly by you from a Spanish bank account. We cannot pay it on your behalf.11. How much will the tax be?

It depends on the cadastral value of the property (shown on the IBI), how it’s used, and your country of residence. Once we receive your documents, we will calculate the exact amount.12. What is your service fee?

Our fee varies depending on the number of properties and owners, but we will always inform you of the price before we start.13. What if I own more than one property?

Each property needs a separate tax declaration. We handle all of them for you, making it easy and clear.14. Do I have to file this tax every year?

Yes. Every year, a new declaration must be filed for each property not rented out.15. What if I don’t file the tax?

The Spanish Tax Agency may:- Apply fines and interest.

- Add the debt to your name.

- Seize funds from Spanish bank accounts or prevent you from selling your property.

16. What if the property is owned by two people?

Each person must file their share separately. For example, if two people own 50% each, then two returns must be filed.17. Can I file this tax myself?

Yes, but it’s complicated and requires a Spanish digital certificate. That’s why most non-residents prefer to have us handle it.18. Do I get a certificate or proof of filing?

Yes. After filing, we will send you a copy of the official Model 210 form as proof.19. Do you file the tax using a digital certificate?

Yes. We are authorized tax representatives and file your return using a secure digital certificate registered in Spain.20. Which bank account is the tax charged to?

To a Spanish bank account in your name. Make sure it has funds between October and March.21. What if I sell the property?

You only have to file for the years you owned the property. After the sale, this tax no longer applies.22. I haven’t filed this tax in years – can you help?

Yes. We can help you file past declarations, although penalties may apply. It’s best to regularize your situation as soon as possible.23. How will the tax agency know I own a property?

They cross-check data with:- Property registries

- Land registry (cadastre)

- Spanish banks

- Notaries and sales records

24. Is it legal to charge tax for a home I don’t rent?

Yes. Many countries, including Spain, apply such rules for non-resident property owners.25. Do I need to declare this tax in my own country?

Please check with your local tax adviser in your country . Some countries allow you to claim this payment as a deduction or credit if there’s a double taxation agreement with Spain.26. I don’t have a Spanish NIE. Can I still file?

You need a NIE (Foreigners Identification Number) to file taxes in Spain. If you don’t have one, we can help you apply for it.27. Is this the same as the Wealth Tax (Impuesto sobre el Patrimonio)?

No. This is not the Wealth Tax. That tax applies to your total assets in Spain. Model 210 is a tax on assumed rental income for owning a property.28. Is this the same as the garbage fee I pay to the town hall?

No. The municipal waste fee is paid to your local town hall. Model 210 is a national tax paid to the Spanish Tax Agency.29. What happens if I rent out my property?

If you rent your property, you must declare for 2 taxes:- Imputed tax (this tax) the real rental income instead. We can help you file the correct tax return.

30. What if I don’t live in the property, and no one uses it?

You still need to file the tax. Spanish law assumes a minimum income for owning a second home in Spain.31. I let family use the house for free — do I still have to file?

Yes. Even if no money is exchanged, the law considers that this tax must be paid.32. Do I need to report this to my accountant at home?

Yes, if your country has a tax treaty with Spain, your accountant may need this info. You might be able to claim a credit.33. Do I need a Spanish tax advisor to file?

It’s strongly recommended. Spanish tax laws are complex and we take care of the entire process for you.34. Can you file for me without a digital certificate?

Yes. We use our official certificate as your registered representative in Spain.35. Do I need to travel to Spain?

No. Everything is managed remotely. You don’t need to visit any office.36. What documents do I need to provide?

You’ll need to send us:

- Your latest IBI/Council Tax bill

Please, note that that we need the COUNCILT TAX BILL which is the one issued by the TOWN HALL and NOT the BANK RECEIPT.

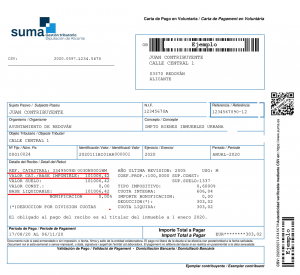

What’s the difference between an IBI bill and a bank statement?

🏛️ IBI Bill (Property Tax Notice)

Issued by: Local town hall (Ayuntamiento)

Shows:

Property address

Tax base value (valor catastral) – The most important information

Tax rate applied

Reference numbers (used for Model 210)

Official logos and breakdown of the tax

Purpose: This is the document we need from you to calculate your tax return.

💳 Bank Statement

Issued by: Your bank

Shows:

Date of payment

Amount charged

Name of the payee (e.g., Town Hall)

Purpose: Only confirms that the payment was made, but might not include the necessary tax details for your declaration.

In case you only have the RECEIPT OF THE BANK, please check if the most important information is included: The Valor Catastral (Catastral Value). With this, the Receipt of the bank will be valid.

37. How do I send my IBI/Council Tax?

By email, just answering to the same introduction email received, and including the IBI receipt in attachment.

38. Will I get a refund?

No. This tax is payable. Refunds only apply if overpayments are made in special cases.

39. I already pay tax in my country — why this too?

You must follow Spanish law if you own property in Spain. This is common across the EU.

40. Will the Spanish tax office contact me?

No. If we represent you, all communication goes through us.

41. How is the tax calculated?

It’s based on the cadastral value, property use, and your country of residence. We calculate everything for you.

42. I co-own with someone from another country. What now?

Each co-owner files separately, even if they are from different countries.

43. Do I need a Spanish bank account?

Yes. The tax will be debited from a Spanish account in your name.

44. My property is owned by a company. Is it the same?

No. That’s a different case. Companies do not pay this tax.

45. What if I ignore this tax?

Eventually, the tax office may find out. Fines and interest will apply.

46. Can my property be seized if I don’t pay?

Yes, if you leave it unpaid for years. Embargoes may be applied.

47. Can I sell my home if I haven’t filed this?

Normally, unpaid taxes must be settled before a property sale is allowed.

48. What if I made a mistake in a past return?

We can submit a correction (rectificación) to amend previous years.

49. Can you file for multiple years?

Yes. We can help you regularize your situation by filing previous years in case you have not done it.

50. I got a letter from Hacienda — what now?

Send it to us as soon as possible. We’ll handle the response and guide you.

51. I own a garage — does it count?

Yes, if it has its own cadastral reference, Garage/Shed etc must be presented in a separate Tax Declaration as an independent property.

So, in case you have a house and an individualized garage (a garage with a separate cadastral reference from the apartment), then you will have to present 2 Tax declarations:

- Tax declaration for the apartment

- Tax declaration for the garage/shed

52. Can a family member act for me?

Yes, but it is not necessary, as we will be representing you.

53. Is your service included in the payment of the tax?

No. Our services are paid apart. You will receive on your bank account 2 payments:

- Payment of our fees: October (this year)-February (following year)

- Payment of the tax: January-March following year

54. Can I pay you from a foreign bank account?

Yes. But we CANNOT GUARANTY SUCCESS on it, and you will be penalized by the administration if the payment cannot be done, and also our company will charge you an extra to solve the problem.

55. I inherited a property — do I pay too?

Yes, from the year of inheritance onward. We’ll help you file from that date.

56. Does land or rural property count?

Yes, as long as it has a cadastral value with a HOUSE. Unbuilt rural land is not subjected to this tax.

57. What if the house is under renovation?

You may be eligible for an exemption. Let us review your case.

58. Can I get an extension?

No. Model 210 must be filed by December 31st for the current year.

59. Can I pay early?

We will present the declarations BEFORE the end of the year, , but the tax will still be charged automatically between January and March of the following year.

60. If I rent the house later, do I keep filing this?

No. Once rented, a different type of declaration must be filed.

61. Can I split the tax payment?

No. The tax is collected in one single payment by the Tax Agency.

62. Are the islands treated differently (Canary/Balearic)?

No. The same rules apply throughout Spain.

63. Do I include utility bills?

No. Model 210 is based only on property value, not actual expenses.

64. Can I deduct my mortgage or repairs?

Only if you declare rental income. Not for imputed income.

65. I file jointly with my spouse abroad — is it the same in Spain?

No. Spain requires a separate return for each co-owner.

Still have questions? Contact us – we’ll be happy to assist you personally.