Absence of certificate of habitation in Andalusia

Which is First Occupation License and Second Occupation License in Andalucía? In Andalucía, there are two main types of occupancy permits, each serving a different purpose: License of First Occupation: This is for brand new buildings. It’s a way for the authorities to confirm that a newly constructed building is safe and meets all the […]

Expropriation of properties in Spain-Land’s Grab

Expropiation in Spain – Spanish property expropriation An expropriation is defined as “to take land without consent of the owner …”. It is hard to imagine an exercise of governmental authority that can have a more direct impact on an owner’s property rights than the taking of an owner’s land without the owner’s consent. As […]

Construction and Sub-contractor contract. Legal obligations for Builders

LEGAL ASPECTS OF THE CONSTRUCTION PROCESS: The builder Terms of the construction contract Terms of subcontracting The subcontractor Builder/Contractor The builder or contractor is the construction agent who undertakes, contractually before the developer, to execute with human and material resources, whether their own or those of others, the works or part of the works […]

Horizontal Divisions. Urbanisations in rustic land in Spain

Horizontal Division in Urbanizations means that the land where the different houses from the urbanization are placed belongs to all the owners “in common”. This Horizontal Division is a way used in urbanizations and buildings where the different owners own the 100 % from their houses and “in community” the land of the urbanization. So, the […]

Ten Years Insurance on Spanish properties

(Seguro Decenal) When you buy off-plan from a builder or developer, or you, by yourself, build new property, the builder or developer, together with the architect, must guaranty you that the essential and most important parts of the construction will be secure at least for ten years, following the Spanish laws. In order to confirm this […]

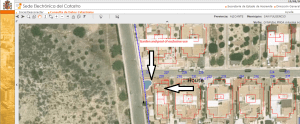

Increase of previous years Council Tax (IBI) for undeclared constructions

When you own a property in Spain, it’s crucial to ensure that all constructions, including any extensions or modifications, are properly declared to the Cadastre (Catastro), the official register of property for tax purposes. Failing to do so can lead to unexpected tax adjustments and financial liabilities, particularly when you decide to sell the property. […]

Legalization of constructions-extensions-update deeds

[vc_row][vc_column][vc_column_text]It is really common in practice that owners of properties, after acquisition, have made new buildings on their properties, or new extensions. For example, a pool, a garage, an outside kitchen or toilette, or a second floor. When this happens, it is necessary to legalize these constructions with a two main actions: Updating deeds, and registering […]

Horizontal division – Spanish Illegal Urbanisations

Horizontal Division in Spanish Urbanisations What Is Horizontal Division? Horizontal Division (“División Horizontal” in Spanish) refers to a legal structure in which different properties—such as houses, villas, or apartments—share ownership of the land on which they are built. This model is frequently used in urbanisations and residential developments throughout Spain. In this framework, each […]

Inspections on properties older than 50 years in Spain

Technical Inspections for Buildings Over 50 Years Old in Spain What foreign buyers and property owners must know to comply with Spanish law Why Building Maintenance Is a Legal Obligation in Spain All EU countries, including Spain, require property owners to maintain their buildings and plots in a safe, healthy, and structurally sound condition. […]

Tax when buying plots for construction in Spain

For the correct identification of the Spanish taxes derived from the purchase of a plot or land intended for construction, several factors must be taken into account: Tax status of the seller Tax status of the buyer Nature or urban classification of the land or plot Nature or urban classification of the construction Table […]